Mahindra Comviva extends mobile money solution from Africa to Iraq

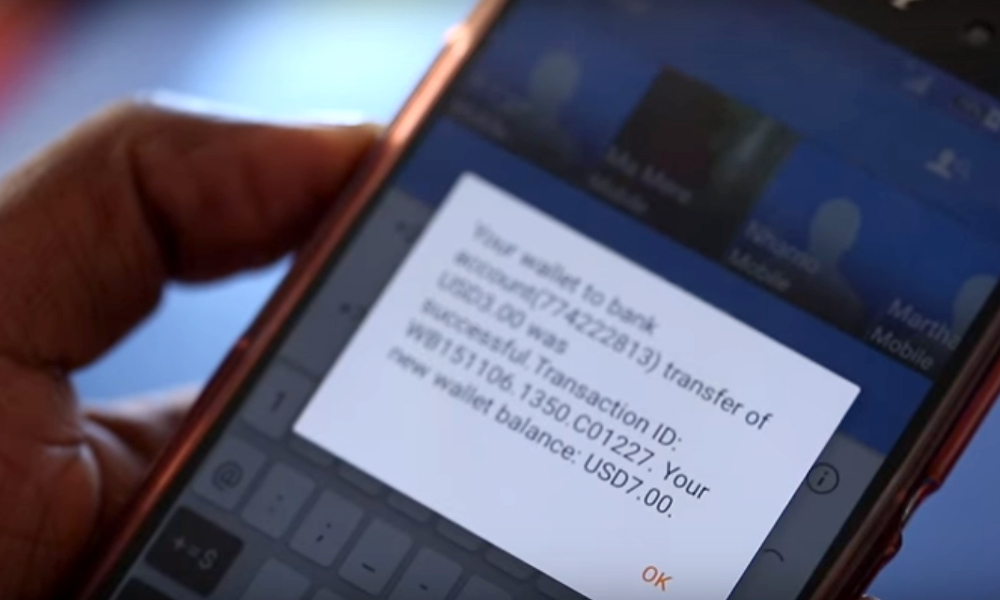

AsiaHawala, powered by Mahindra Comviva’s mobiquity Money, is the first mobile commerce service launched in Iraq. In war torn Iraq, corruption in both private and public sector banks have combined with the prevailing rudimentary banking infrastructure to leave segments of the population without any access to any banking facilities. AsiaHawala fills this gap by leveraging the ubiquity of the mobile to provide remote payments facility to the unbanked as well as the underbanked.

Besides providing transactional security for a wide range of payment activities like bill payments, money transfers, merchant payments, salary disbursements and e-wallets, AsiaHawala has provided employment opportunities to small merchants by making them their agents, thus contributing to the GDP of Iraq.

Speaking on the occasion, Zring Faruk, CEO AsiaHawala said, “AsiaHawala is filling the gaping hole left by the non-existing banking infrastructure in Iraq. By leveraging the near ubiquitous penetration of the mobile phones, we are providing ordinary citizens with mobile commerce facilities from the comfort of their homes. We will continue to provide superior and innovative services to the people of Iraq.”

Speaking on the occasion, Kaustubh Kashyap, Vice President Middle East and North Africa, Mahindra Comviva said, “We will continue to invest in such technologies and deliver solutions to serve all the segments of the society, banked, under-banked and the unbanked.”

Mahindra Comviva mobiquity Money has clocked over 65 deployments in more than 45 countries with excess of 40 million mobile wallet accounts, processing 200 million transactions, valuing $4 billion per month. Across Africa, Mahindra Comviva is a leader in mobile money. mobiquity Money powers approximately 30% of mobile money services in Africa, transforming lives of over 48 million Africans by providing easy access to cost effective mobile money services to the marginalised population. The corporate vision is to leverage mobile technology to bring financially underserved into formal financial mainstream and create cashless economies in Africa and across the globe.

9.6% of Africa’s adult population use mobile money services powered by the mobiquity Money platform. Success has been achieved on this scale by enabling clients to establish a robust agent network and partner ecosystem, spreading mobiquity Money into various public forums, and mobilising new users into mobile money services. There are 45 successful mobiquity Money deployments in 32 African countries with 180 million transactions, amounting to a $3.5 billion per month.

Signup to the Intelligent CIO Africa newsletter and never miss out on the latest news