The Reserve Bank of New Zealand, New Zealand’s central bank, has chosen SIA, a European vendor in technology infrastructure and services for financial institutions, to implement and support a new Real Time Gross Settlement system replacing the current Exchange Settlement Account System. The Real-Time Gross Settlement is a system that electronically streamlines the settlement of large value transactions between banks. SIA will use its wholly owned subsidiary Perago, based in Pretoria, South Africa, specialised in central banks solutions.

Deputy Governor Geoff Bascand said: “Our preferred approach was to find and use an existing off the shelf system rather than build a new bespoke system. The contract with SIA achieves that goal. The Perago RTGS system has a rich list of features that we can consider for deployment. We sought a system with substantial processing capacity and the Perago solution will allow for significant volume growth and high throughput rates.”

The functionality of the existing ESAS system will largely be incorporated into the replacement, including auto-overnight reverse purchase of eligible securities, tiered interest, authorisation and liquidity management features, and key interfaces to the SWIFT messaging system.

“After an initial planning phase, we expect to start settling on options and features in the second half of this year, with installation of the new RTGS to follow,” Bascand said.

Along with implementation of the Perago RTGS system, the Reserve Bank will replace the underlying payment system IT infrastructure, which is currently integrated with the corporate IT infrastructure. The new RTGS will operate on a standalone IT infrastructure that incorporates substantial redundancy and resiliency features.

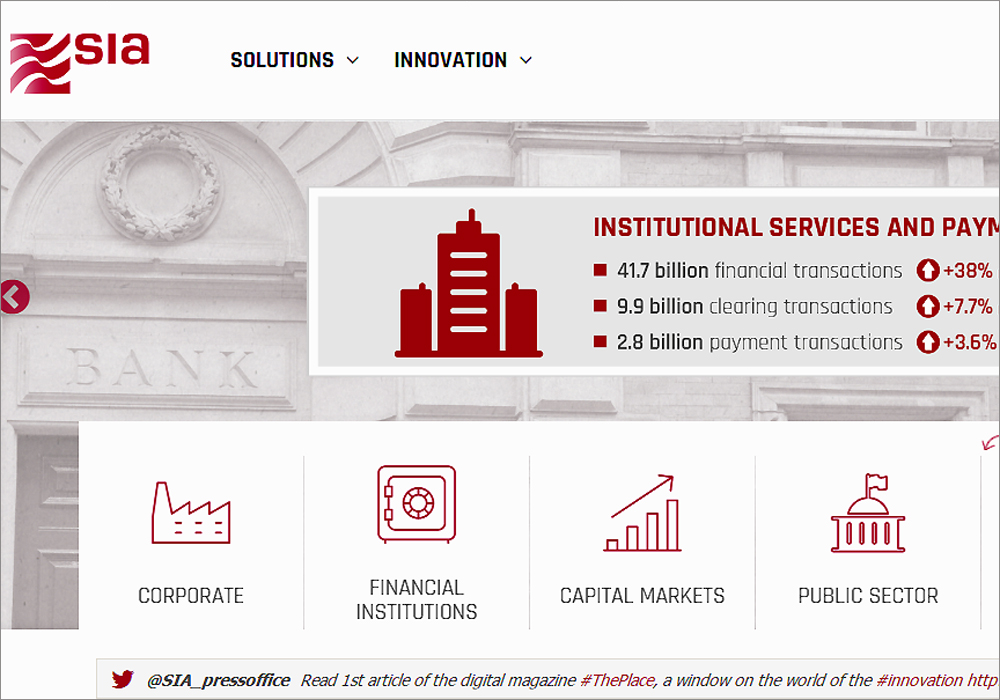

“We are very proud to have reached this significant agreement with Reserve Bank of New Zealand,” commented Massimo Arrighetti, CEO of SIA. “With RBNZ, the number of central banks in the world which have decided to use SIA’s technologies to develop their own payment infrastructures has risen to 14, across Europe, Africa, the Middle East, and now also Oceania.”

Click below to share this article