In a competitive market, Digital Transformation is the key to survival for banking organisations. Intelligent CIO has spoken to Naji Kazak, General Manager – Middle East, Africa, Turkey and Russia at Alaris, a Kodak Alaris Business, about how successfully the sector is transforming.

What are your views on digitisation trends in the Middle East?

Digital Transformation is a hot topic in the Middle East. You look at governments and financial institutions and you feel the importance of going digital to them, if we talk about banks in specific then you look at the digital channels they open to their customers to complete transactions that were previously done in a branch through a mobile application, application can be done online, money transfers too, some banks even introduced cheque depositing through their mobile application, others introduced virtual branches.

Competition is increasing among banks and Digital Transformation is a key to their survival, this is mainly driven by the need to excel in customer satisfaction and reduce operational cost.

Tell us more about Alaris and what services it can offer to financial institutions?

Data comes in from different channels. It can be on paper or digitally born or even on social media. Banks and financial institutions have invested a lot in various systems to accommodate the large amount of data they generate, while some have already introduced Artificial Intelligence and robotics into their processes.

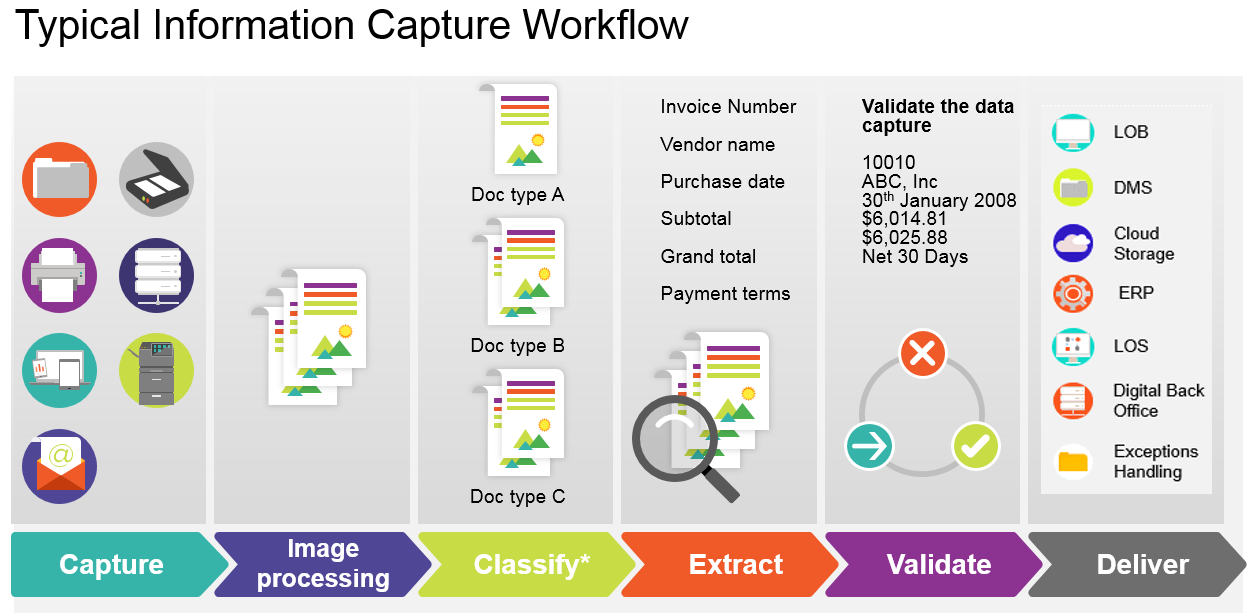

There is a growing challenge in how data is handled and being a paper centric region makes the challenge harder. Alaris expertise lies in optimising the workflow of data capturing, regardless of the source of data we take optimised images of data in preparation for data classification and extraction. In many cases financial institutions need to validate the data provided before putting them into a business process and this is something that we help automate.

How did the company come to be what it is today?

Kodak Alaris is a spin off company of Kodak Eastman that is well known for its imaging science. We proudly inherited this part of the business and specialised in it. We were the first to manufacture a high-volume document scanner in 1990, typically these scanners operate 24/7 with very little downtime, and today we have an extensive portfolio of scanners that cover speeds from 20 pages per minute to more than 400 pages per minute.

We have worked with the likes of Central Bank of Egypt, National Bank of Egypt, Emirates NBD and ADCB to name a few. We have partners that use our technology to provide digitising solutions to most of the banks in Saudi Arabia, so we have been able to build a great reputation across the region. As I said data is no longer only on paper, many documents come in a digital form but still need to be captured, hence our investment in the software space to automate the image capture process.

Additionally, we provide professional services to help clients in planning and implementing their Digital Transformation journey. All together, we bring a unique proposition to clients where they need to deal with only one entity to provide them with an end-to-end solution.

We believe our products can solve a lot of business issues, whether it’s transformation and digitisation of e-governments or banks or companies that aim to move away from paper-based processes. It is complicated and demanding to access data that is on paper.

Data is the new currency, even more so for this region. We all must work towards figuring out ways to make companies more efficient in this new digital age. We believe that our scanning solutions, capable to integrate into customers’ businesses, will allow them to be more efficient by transforming themselves. This is our objective across the world and in the Middle East region as well. With our team based out of Dubai, we have had great success stories in various countries and a remarkable 2018 in the region.

What common challenges do you see banks face in managing their processes?

According to a survey conducted by Souqalmal.com in 2018 only 32% would recommend their bank, it represents a 7% increase from 2017 a drop of 2% from 2016, which is alarming really.

When you dig into the reasons of dissatisfaction you would find things like frustration with papers and forms, the need to supply the same information repeatedly, the long time to decide on applications and loans.

Banks’ employees also recognise these problems as 49% of employees state that data getting lost and speed of the process are the biggest two challenges they face. Having said that, banks need to deliver service faster than ever and studying the journey of those applications is an absolute necessity if banks want to improve customer satisfaction.

Alaris helped a bank in the region reduce their loans processing time from seven days to one day, we provide the expertise and the know-how to assist banks with these matters.

Customers need services at their fingertips and they need it now, we see banks analyse their branch-customer interaction and take decisions based on the customer experience. Cheques is a great example, the customer journey for depositing a cheque is very time consuming, initially customers were required to deposit cheques at the teller, now they have the option of depositing cheques through an ATM yet they still need to waste their time traveling to the location.

Excellence in customer satisfaction requires a step further towards innovation and digitisation, now you see some banks offer cheque depositing through their mobile application removing the need to visit a branch or an ATM.

Looking at how banks approach their legacy systems right now, would you do things differently? Why?

I wouldn’t say that. Technology develops and improves every day, while some systems are more efficient than others it would be naïve to say that investing in a new system is the only way forward, banks have invested a lot of time and resources in employing these systems and any new systems to be implemented need to integrate well with the existing business process. We understand this very well that is why we have a fully equipped team to help banks integrate our solutions to their existing processes.

Click below to share this article