Located in some of the most volatile global regions, Lebanon and Iraq are moving forward in adoption of digital transformation and tech startups with demand for datacentre and cybersecurity solutions.

Along with tourism, many Levantine governments have prioritised the ICT sector to drive their economic development agendas in the absence of abundant natural resource wealth. From establishing dedicated ministries for digital economy to designing ambitious national digital transformation programs, national governments throughout the region are committed to ensuring that the Levant is a fertile ground for entrepreneurship and innovation.

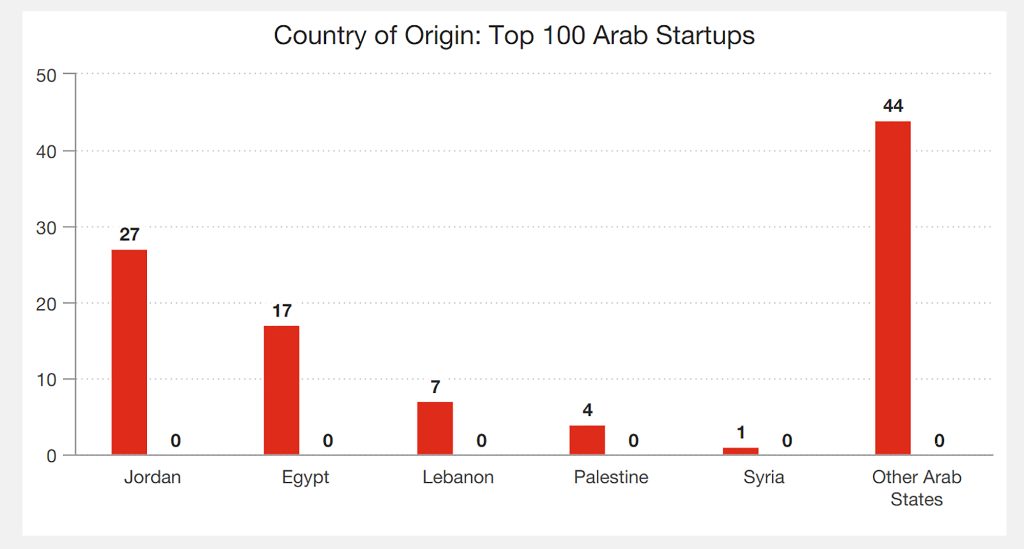

The benefits of this focus are beginning to show. WEF estimates that the Levant is now home to more than half of the Arab World’s top one hundred startups.

Looking beyond the top-line numbers, several case studies exist. The ICT sector in Lebanon accounts for approximately 3% of GDP and the government is committed to strengthening and retaining local talent while seeking to build on legacy public initiatives such as Circular 3318 to attract new investment in ICT infrastructure and other digital environment projects.

Meanwhile, in 2016, Jordan revised its national digitisation strategy – Reach 2025, to set an ambitious objective to digitise the entire Jordanian economy, of which the ICT sector makes up 13%. Egypt is following suit with plans to double its ICT sector’s economic contribution from 3% in 2017 to 6% by 2025, primarily by investing in digital infrastructure, platforms, and financial services.

Business outlook

The fiscal outlook for Levantine countries is complex. Government borrowing throughout the region accelerated after 2010, with Lebanon in particular accumulating a large debt load. At 157% debt-to-GDP in 2019, Lebanon is the third most indebted country in the world. The IMF projects this figure to continue growing through 2024, to reach nearly 180% of GDP.

Debt in Egypt and Jordan has also risen significantly since 2010, reaching approximately 100% of GDP in both countries.13 In recent years, the latter two countries have turned to the IMF for financial assistance and are implementing structural reforms to address their fiscal challenges.

Credit worthiness throughout the region remains in focus, with all 3 major credit rating agencies declaring government bonds for many countries in the region to be non-investment grade. This raises borrowing costs while constraining access to international credit markets and potentially turning away much-needed foreign investment.

Reform remains underway in the region. Jordan and Lebanon are implementing various fiscal and budgetary changes. Egypt has seen measurable success by reducing their budget deficit to 9.5% in 2018, its lowest level since 2011, and slashing its public debt by 10 percentage points in just two years to 93%.

The opportunities for the Levant appear to outweigh the existing challenges as long as countries continue pursuing efforts to build sustainable economic growth. Tourism and digital innovation will remain key priorities, and the drive towards renewables will likely intensify as governments seek to reduce the energy burden.

Fiscal reforms should also continue given the need to gain investor confidence to improve foreign investment and capital inflows. That said, short-term growth will most likely continue to depend on public expenditure and free regional trade measures will likely remain on hold considering the current regional circumstances.

Mindware in Iraq, Lebanon

Mindware has been serving the Levant market for more than 20 years by offering end to end technology solution. With the ongoing economic development in the region, technology adaptation and digital transformation initiatives, the need for the latest technology solutions is a must by both private and public sector.

Mindware is working closely with strategic partners in the Levant region including Lebanon, Jordan and Iraq including system integrators, corporate resellers, ISVs, cloud providers, telecom operators, to promote and provide the latest technology solutions. This includes datacentre, security, cloud, virtualisation, networking, and power.

Digital transformation is driving the entire economic change in Levant, primarily Iraq and Jordan. Mindware along with its strategic partners in Levant is covering various sectors with a focus on public sector, banking and finance, oil and gas, telecom, and manufacturing.

The Levant region have been experiencing rapid growth in their technology sector, with a focus on information and communication technology solutions. Some of the technologies and solutions that are in demand are cloud computing as they allow businesses and organisations to store and process data more efficiently and cybersecurity solutions especially with the increase threat of cyberattacks.

With the increasing adoption of cloud computing and digital transformation, there is a growing demand for datacentres and networking solutions that can support these technologies. Companies and organisations in the Levant Region are increasingly investing in datacentre infrastructure, such as servers, storage, and networking equipment, to support their digital transformation initiatives.

Mindware has 40+ top vendors in its product portfolio covering multiple technologies including, Data Centre, Infrastructure, Networking, Security, Virtualisation, Power Solutions and Cloud.

The main vendors operating in the Levant region who are part of the Mindware solution stack include: Dell Technologies, Microsoft, Lenovo, IBM, Huawei, Citrix, Veritas, Juniper, Symantec, Trend Micro, RSA, Vertiv, Eaton, TP-Link, Forcepoint, Archer, Autodesk, Rubrik, etc.

“The overall political and economic instability in Levant is the major bottleneck in the growth of the economy and investments in the technology field. Currently, as the situation is better in both political and economic areas, we can see investment and development especially in technology. We can still see challenges in the financial and logistics area due to absence of a developed banking system. However, with the right strategies and partnerships, these challenges can be overcome to create opportunities for growth and success,” explains Toni Azzi, General Manager, Qatar, Levant, and Africa at Mindware.

Driving fintech

The Levant has witnessed a trend that sets them apart from their Gulf neighbours: rising remittances. As the region, experiences rising populations, many people from the region seek employment in neighbouring GCC countries. When workers seek employment outside their home country it does have an impact on local productivity, but the remittances they send back to their families also impacts their home country’s economy.

Over the past several years, these remittances have contributed to GDP growth, bolstered domestic bank deposits, helped to finance imports, and increased foreign currency reserves while having minimal impact on the inflation rate.

Lebanon has seen remittances steadily grow over the past few decades, reaching a record high of 25% of GDP in 2005, with two-thirds coming from expatriates in the GCC region. Recently, however, the volume of remittances has declined as regional economic growth slows. In 2016, for example, remittances measured only 11% of GDP for Lebanon, although it remains the largest recipient of remittances in the region and the Arab world.

In Egypt, ranked second in the region for remittances, remittances are more important than ever to the economy after the government floated the Egyptian pound. Remittances are one of the main sources of foreign currency and have risen from 5% of GDP in 2016 to 11.5% of GDP in 2018. In Jordan, remittances continue to rise, accounting for approximately 9% of GDP in 2016, mainly from Jordanian expats in the GCC region.

Content excerpted from Five economic trends to follow in Levant region, by PwC Middle East.

Click below to share this article