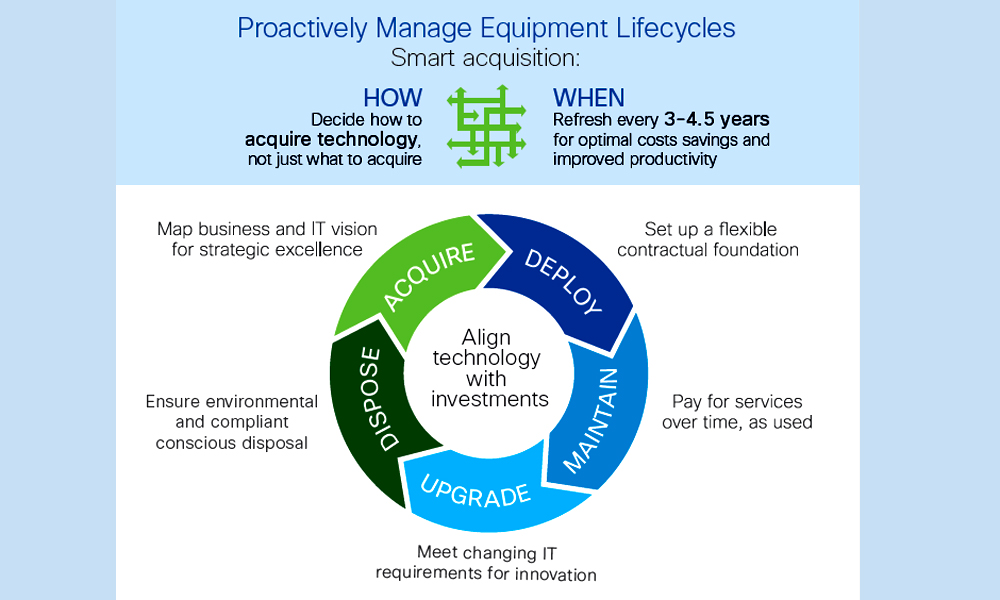

As businesses move away from investing time and money to buy technology towards a focus on how best to use technology, the need to approach financing in more innovative ways also comes to the forefront. Globally technology and other B2B services are moving towards a more utility and pay as you go approach. End customers are beginning to see the benefits of focusing more on their core business challenges rather than being overwhelmed with technology challenges. Typically these challenges appear in the form of product life cycle management including selection of technology, purchase, maintenance, upgrade and obsolescence.

For businesses today managing the cost of technology over its life cycle is becoming an increasingly important focus. Businesses want to commoditise the usage of technology as a known and predictable cost over its lifetime. “There is always a financial wrapper because there is always an investment, return on investment, and a total cost of ownership discussion. It is becoming increasingly important as people move from just simply buying technology to basically buying usage of technology and buying business outcomes,” explains Sven Jirgal, Vice President and Chief Operating Officer, Cisco Systems Capital Corp.

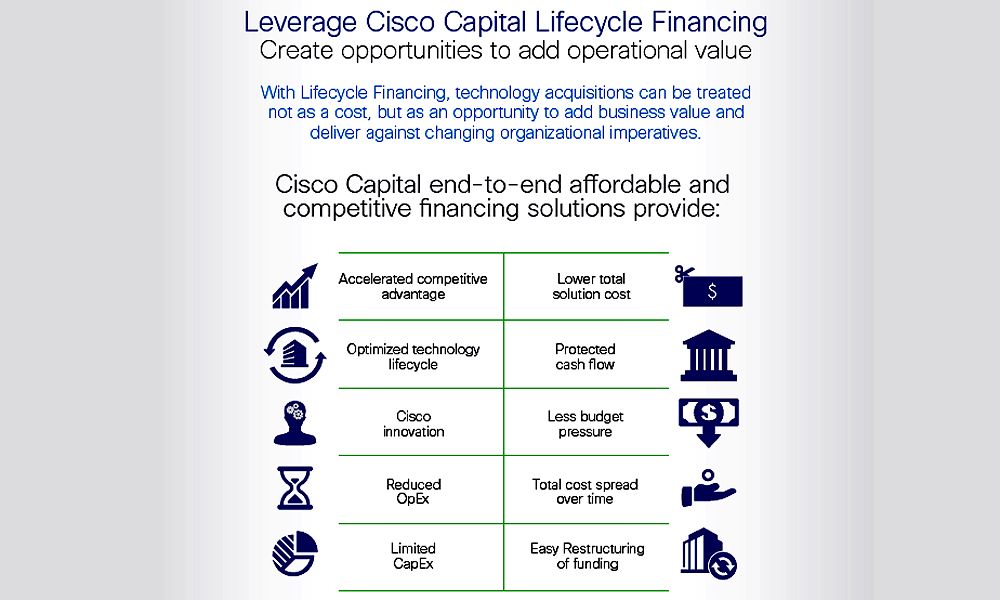

Cisco Capital is a wholly owned subsidiary of Cisco, operates globally and across Africa and Middle East, and manages the circular product life cycle. Cisco Capital offers channel partners and end customers, options to upgrade and add equipment as part of a financing agreement. This helps to plan out the technology roadmap more strategically without necessarily requiring further capital investment. Cisco Capital financing helps to integrate asset management with financing strategy and optimise return on investment while lowering total cost of ownership. The costs of implementation, servicing and maintenance costs can also be added, spreading upfront costs over time.

There are three key reasons for Cisco Capital’s go to market initiatives. The first is to differentiate itself from amongst other vendors and to meet end user expectations during purchase negotiations. The second is to provide an alternative form of technology ownership model. And the third is to provide an alternate and additional stream of credit for channel partners and end customers.

“We are basically there to help Cisco customers and partners adopt Cisco technology and provide the financial wrapper for that adoption. Because they acquire technology, they use it and at some point of time they do not need it anymore. They upgrade it or dispose them. We take that back. That is what Cisco Capital does,” adds Jirgal.

IT vendors at the forefront of technology life cycles need to find ways of ensuring manufactured products are put to their best use across their complete lifespan. Manufactured products are sometimes displaced from the mainstream sales cycle from a number of sources. Distributors may be unable to sell-through their complete stocks over a period of time and are allowed a certain percentage of returns. Customers may return unused products due to a wrong order shipment. Products may be moved to various places for proof of concept or demonstrations and then returned. As part of a financing arrangement, products may be traded in or returned at the end of the lease agreement.

All these returns creates a pool of inventory that needs to be managed. Products are separated into those that have a secondary value and those that do not. Any product that has left the manufacturer and been shipped and has not been sold for any of the above reasons needs to be re-inspected. This needs to be done before it can be returned into the regular sales channels. Those products that have been used and returned as part of a lease financing arrangement also need to be refurbished. They are refreshed and upgraded as best as possible and on what makes sense. Finally those assets that have no secondary value are disposed in an ecologically friendly way. “Like any other company we have a reverse logistics function too where we take products back.”

Cisco products that have been re-manufactured and refurbished in this manner are made available for repurchase through the regular sales channels. A channel partner would see the inventory of these products with technical specifications similar to the inventory of other prime products. The only difference in the listing being the price and a suffix indicating the source originating through reverse logistics. For all purposes re-manufactured products follow the same ordering and shipping procedures, channel partners would earn the same rebates, and end customers would get the same service support, similar to any Cisco prime product.

Contrary to first impressions, such re-manufactured products have significant demand in certain applications areas and are not canabalising prime new products. “Where we see the most uptake for re-marketed products is actually in managed service applications. The customer does not care what product is actually used to deliver the managed service. And the service provider is looking for a cost effective way to deliver that service,” elaborates Jirgal. Traditionally, Cisco managed services has seen the most uptake in US, Western Europe, Japan. But Jirgal says the business has grown fourfold in the Gulf over the last 18 months, and includes the who is who of the industry.

Managed services using re-manufactured Cisco equipment are a win-win situation for end users, channel partner and vendors. They use products that give the same performance as new, but at a slight price discount. The recent spurt in uptake of managed services across the Gulf is also indicative of the growing maturity of the regional IT services industry to meet constrained end user budget expectations.

In another opportunity area, Jirgal points out the maximum number of queries Cisco Capital receives is around financing to meet on-demand type of solutions. This includes cloud application and datacenter type of solutions amongst others. Channel partners and end customers are ready to engage with the proposition of having a base demand, and an indication of increased usage over time, but of unknown burst size and duration. For such a combination of requirements, typically exhibited during entry into digital transformation solutions, Cisco Capital offers its Open Pay solution.

Under the Open Pay service agreement, the Cisco Capital customer contracts the entire technology solution requirement but pays only for the base amount of technology. As the customer requirement scales above the base amount the incremental usage is billed at a predetermined amount across predetermined time slots. Open Pay typically applies to converged infrastructure and datacenter solutions including cloud from Cisco with the minimum technology investment at $0.5 to $1.0 million. It is meant to simplify technology provisioning, add business agility, and create a pay as you go business model.

The Open Pay service model from Cisco Capital is still in the early stages of trial in the region. “We are ready but we have not done a lot of transactions yet. It is pretty revolutionary and nobody else does it in the market,” adds Jirgal.

Other solution areas where there is demand for Cisco Capital services is around smart solutions, extended projects of long duration, managed services, other utility type of demand base projects. In general Cisco Capital will sign up with the channel partner, service provider, end user, in increments of three years. This is to manage the technology refresh while the actual project may be of longer duration.

Jirgal differentiates the Middle East region by pointing out the underlying regional purchase dynamics is still very much driven by an ownership culture. Most of the purchase activity especially for the public sector is infrastructure build out and large network deployments. This dictates the nature of the dominant service from Cisco Capital. “Most of what we do here in the region is more of a financial cash flow model where the customer ends up owning the equipment and not returning it.

On the other hand across Africa, and especially in those countries where Cisco Capital is less active, it prefers to involve local and international banks that are part of its network. The Cisco Capital team will act as a go-between the end customer or channel partner on one side and the negotiating local bank on the other side. In some cases the local bank may even be the house bank of the contracting customer itself.

Jirgal describes the process managed by the team. “They give comfort to the local bank that someone from Cisco actually knows what is being sold. For the customer they try to give a good Cisco financing experience. They bring the two parties together and then basically get out of the way.” While Cisco Capital enables the sale, the banking and funding relationship is between the local bank who knows the regional market well and the contracting customer.

With Cisco Capital, financing and enabling regional channel partners to roll out disruptive, smart and innovative technology solutions, a significant bottleneck gets out of the way allowing them to move forward with early end user adopters.

Overview Cisco Capital

Even the most effective technology solutions need refreshing and updating. Cisco Capital offers options to upgrade and add equipment during the term of the financing agreement. This helps to plan out the technology roadmap more strategically without necessarily requiring further capital investment. Cisco Capital financing helps to integrate asset management with financing strategy and optimise return on investment while lowering total cost of ownership. The costs of implementation, servicing and maintenance costs can also be added, spreading upfront costs over time.

Click below to share this articleActivities

- Financing options for Cisco hardware, software, services, third-party equipment

- Extended credit and payment terms beyond Cisco’s standard net 30-day terms

- Manages re-manufacture, re-marketing, resale of Cisco Certified Refurbished Equipment

Benefits

- Conserve business cash to be used for strategic investments or business expansion

- Conserve own lines of credit leaving it free for other investments

- 100% of Cisco equipment, software and services costs financed and part financing for supporting non-Cisco equipment

- Fixed monthly or quarterly payment plan helps controls and budgets

- End of lease option allows return, purchase and upgrade

- Capital lease with right to purchase at the end of the term

- Operating lease allows upgrade at the end of the term

- Sale and lease back which does not require write off

- Bundle in services with financing