South Africa is considered to be the most developed cloud market in sub-Saharan Africa. The increase in demand for data storage is also leading to an increase in the demand for data centres. In 2022, South Africa witnessed a surge in data centre investment from global data centre operators, as well as the expansion of local data centre facilities.

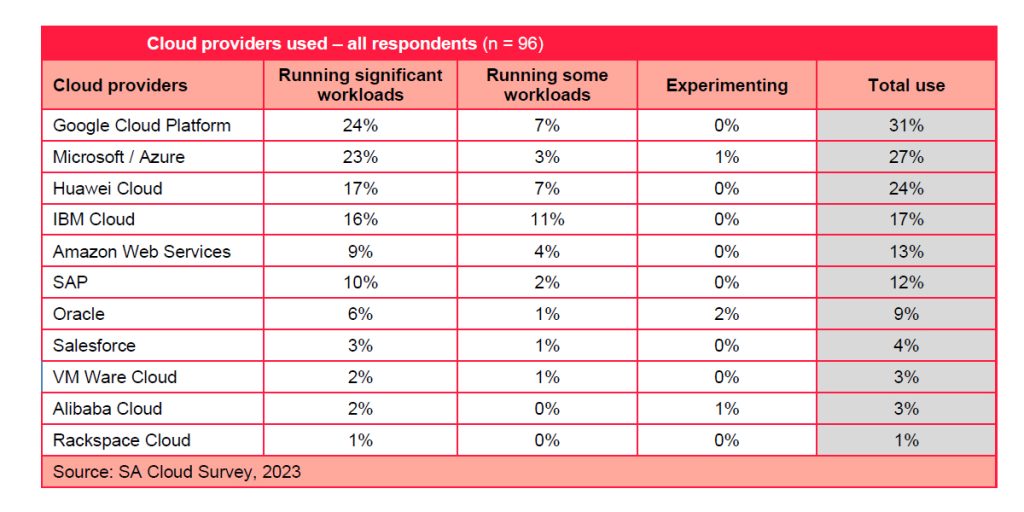

To serve the growing demand for cloud services, global cloud providers, Amazon Web Services, Google Cloud Platform, IBM, Microsoft, Oracle, SAP, VMware and others have targeted South Africa. A number of them have established cloud regions in the country, enabling localisation of services and apps for rapid deployment of cloud solutions. The emergence of these cloud regions has also been driven in large part by the legal data residency requirements, whereby data generated in South Africa must stay in the country.

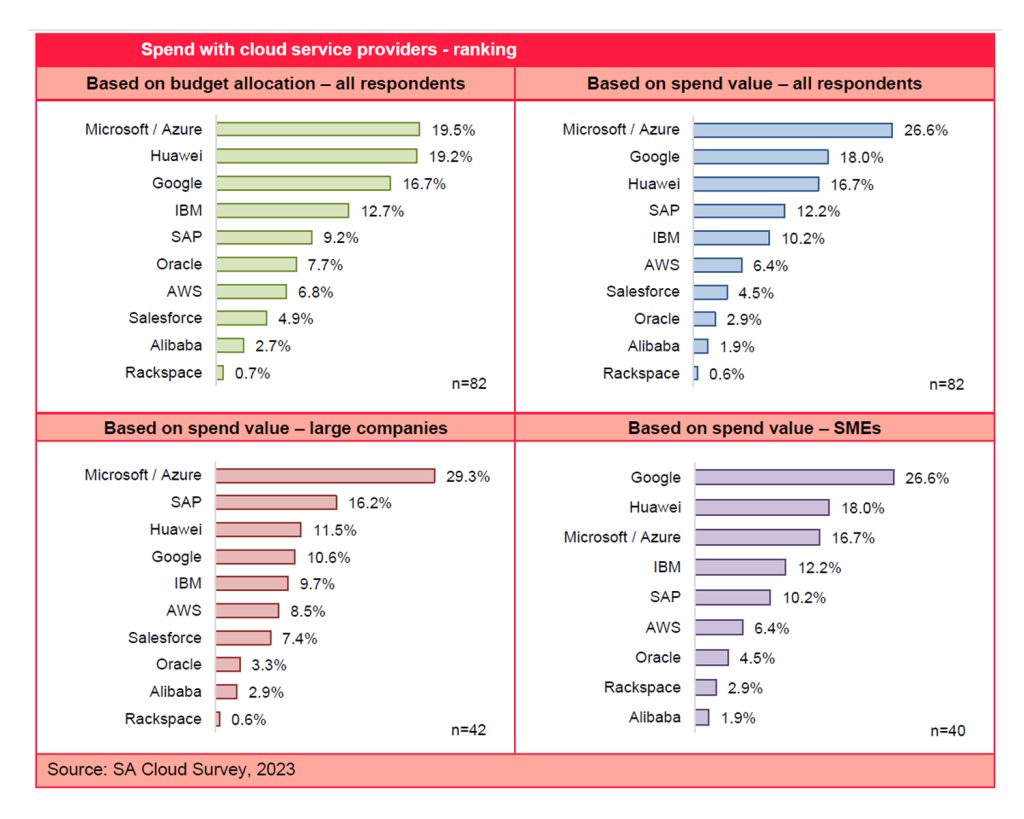

South Africa is also a market of importance to the Chinese cloud providers, Huawei and Alibaba. Huawei has been aggressive in terms of its cloud expansion strategy in South Africa, targeting at least 10% market share by the end of 2022. Huawei’s approach to increase its market share is to provide everything as a service. It relies on its Cloud Spark Programme, a partner development initiative, and has set aside R100 million for South African SMEs to help them adopt cloud computing. Alibaba partnered with BCX in Q3 2022 to increase the uptake of its cloud solutions. It employs a similar strategy to that of Huawei, focusing on SaaS services to grow its market share.

As the competition in the cloud market intensifies, the cloud providers are trying to strengthen their competitive positioning by increasing their partnership with third-party cloud service providers such as BCX, Datacentrix, Dimension Data, EOH, IOCO, to expand their cloud reach. It will be critical for cloud providers to focus on value propositions such as cost reduction, cost transparency, security, convenience of hybrid, multi-cloud implementation and support.

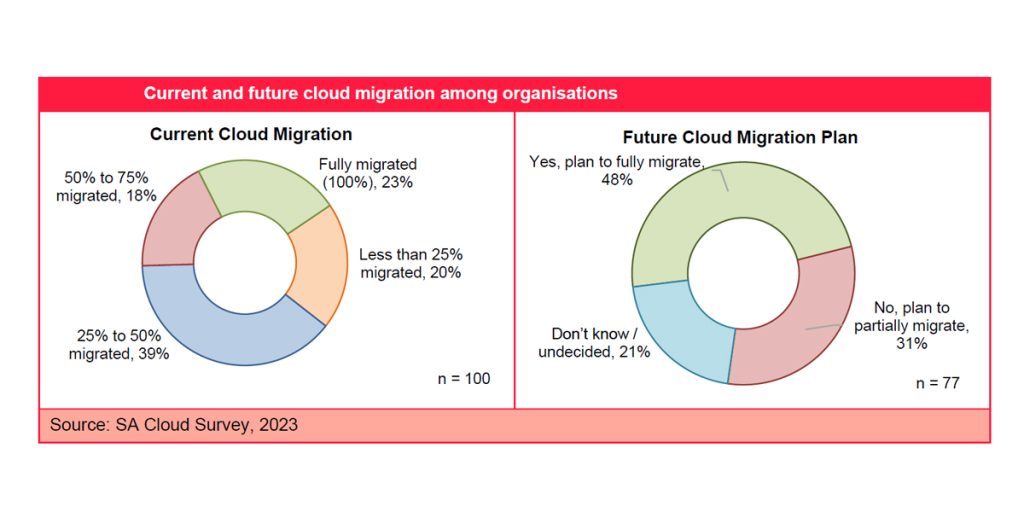

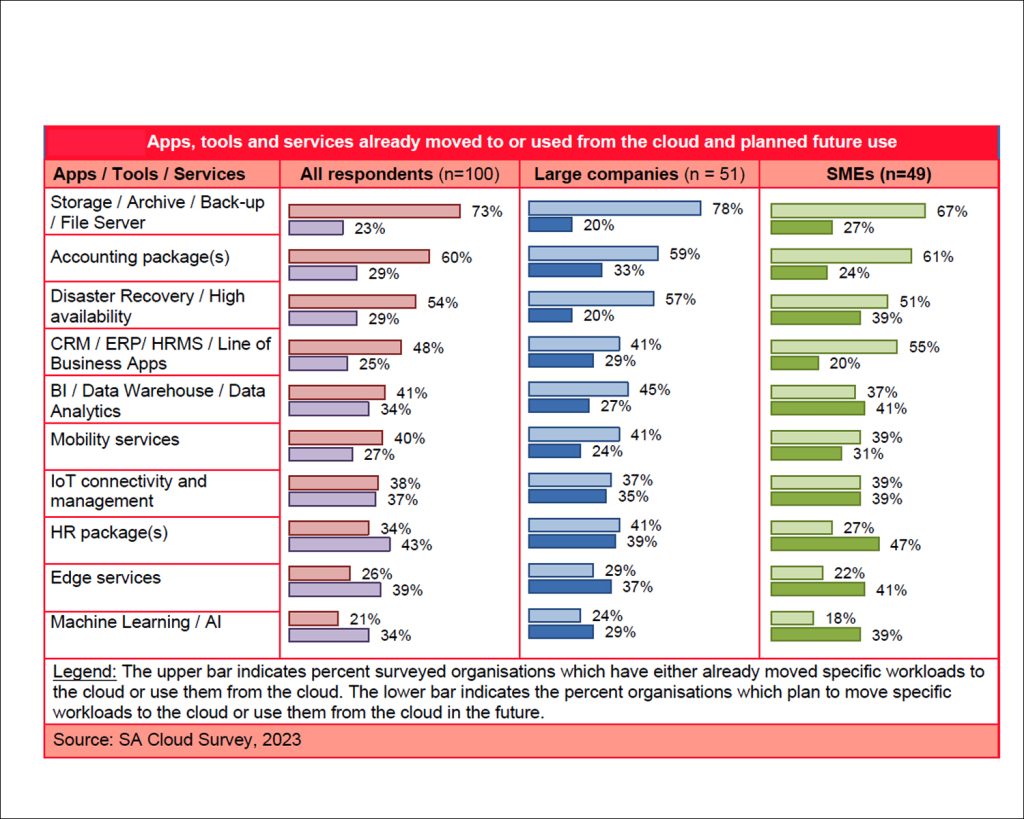

Cloud migration has been progressing in South Africa and accelerating over the past few years. Just over 40% of the cloud survey respondents have already migrated more than half of their workloads, apps and service to the cloud. Among those organisations that have not yet fully migrated, 48% plan to migrate fully to the cloud in the future.

The vast majority of respondents used a hybrid cloud model, public and private cloud, with a further 23% using private cloud only. About one-third of the organisations which practice a hybrid model use a single public cloud and multiple private clouds as the preferred combination. A further 27% use multiple public clouds and a single private cloud.

Currently, 60% of the surveyed organisations use IaaS, while 31% and 15% use PaaS and SaaS, respectively. With investment in IT modernisation to pave the way for digital transformation, it is expected that the emphasis may be initially placed on IaaS as organisations move to the cloud. As the uptake of IaaS slows down, PaaS and SaaS are expected to experience stronger growth – initially PaaS, followed closely by SaaS.

The main challenges of cloud migration are cost optimisation post migration, managing apps post migration, selecting the right cloud provider, and deciding which workloads to move to the cloud and prioritising the workloads for migration.

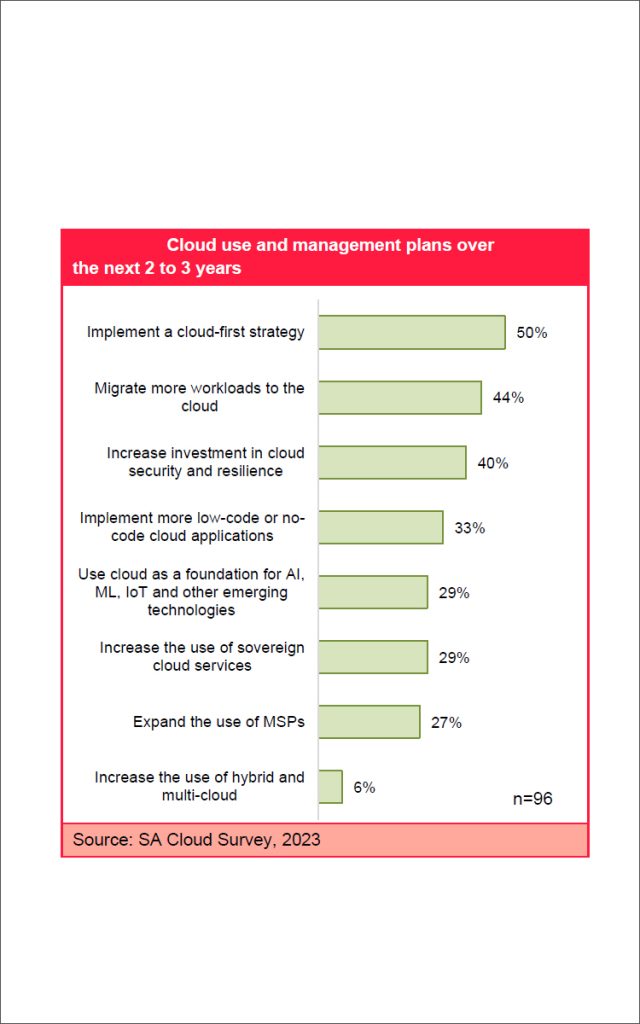

Cloud demand is expected to rise as organisations in South Africa increasingly undertake digital transformation. The surveyed organisations indicated a general intent for greater cloud use in the coming years. Half of the surveyed organisations plan to implement a cloud-first strategy and 44% plan to migrate more workloads to the cloud.

Security around cloud is one of the biggest concerns among organisations in South Africa. The indicator of 40% of the surveyed organisations planning to increase their investments in cloud security and resilience speaks to this, as well as the situation related to frequent power cuts by the national power utility.

Source: South Africa Cloud Survey Report, May 2023, by Africa Analysis SA, Nymbis Cloud Solutions, Veeam

Click below to share this article